Company Profile

-

Company Name Yuanta Securities (Cambodia) Plc.

-

Foundation February 24, 2010

-

Licenses Underwriter, Dealer, Broker

-

Financial Year December

-

Paid-in Capital USD 12.5 million

-

Head Office 4th Floor, Emerald Building, No. 64 (corner St. 178), Preah Norodom Blvd, Sangkat Chey Chumneah, Khan Daun Penh, Phnom Penh, Cambodia

-

Shareholder Yuanta Financial (Hong Kong) Limited.

(Subsidiary of Yuanta Financial Holdings, Taiwan)

-

Milestones of Yuanta Securities (Cambodia) Plc.

2007Opening of TONGYANG Securities Inc. Representative Office in Cambodia

2008Concluded Memorandum of Understanding (MOU) with the Ministry of Economy and Finance

2010Incorporation of TONGYANG Securities (Cambodia) Plc. as the 1st fully-licensed securities firm in Cambodia

Concluded Financial Advisory Services Agreement with the Ministry of Economy and Finance as the exclusive financial advisor to the MEF in the securities sector

2012The Sole Underwriter of the Initial Public Offering of Phnom Penh Water Supply Authority (the 1st IPO in Cambodia)2014Acquisition of TONGYANG Securities Inc. by Yuanta Securities

2015Change in company name from TONGYANG Securities (Cambodia) Plc. to

Yuanta Securities (Cambodia) Plc.2016-2017Fundraising of approximately USD 70mn for ACLEDA Bank through introducing the Bank’s USD

term-deposit product to Korean retail investors (Joint advisor with Yuanta Korea)

2018Joint buy-side advisor to DGB Financial Group in acquisition of one of the leading specialized banks in Cambodia

Sell-side advisor to Korea Deposit Insurance Corporation (KDIC) and shareholders of Tomato Specialized Bank

2019Sell-side advisor to the MEF and shareholders of Cambodia Reinsurance Company

The Sole Underwriter of the Public Offering of Corporate Bonds issued by LOLC (Cambodia) Plc.(the 1st issuer of FX-indexed bonds in Cambodia)

2020The Lead Manager of the Initial Public Offering of ACLEDA Bank Plc. (the 1st IPO of a financial Institution in Cambodia)

The Lead Manager of the Public Offering of Corporate Bonds issued by Phnom Penh Commercial Bank Plc.

"The First Licensed Securities Firm in Cambodia. The Sole Underwriter of the First Initial Public Offering in Cambodia"

Formerly known as TONGYANG Securities (Cambodia) Plc., Yuanta Securities (Cambodia) Plc. (“YSC”) is the leading securities firm in Cambodia with a long-term presence since 2006.

Starting as a Representative Office named Tong Yang Securities Inc, Yuanta Securities (Cambodia) Plc., was incorporated in February 2010 under the name TONGYANG Securities (Cambodia) Plc. While making contributions to the development of Securities Market in Cambodia along with the Cambodian government, Yuanta Securities (Cambodia) Plc. has achieved several remarkable feats: exclusive financial advisor to the Ministry of Economy and Finance (“MEF”), the first fully-licensed securities firm in Cambodia, and the sole underwriter of the first Initial Public Offering in Cambodia.

In June 2014, Yuanta Securities acquired TONGYANG Securities (Cambodia) Plc.’s parent company based in Korea. This transaction has expanded our global financial network to include Taiwan, Hong Kong, China, Korea, Vietnam, Philippines, Thailand, Indonesia, and Myanmar. Utilizing its vast Asian network, the dedicated YSC team will fully leverage its rich experience and expertise to serve the needs of our valued clients and provide optimal financial solutions. Today,

Yuanta Securities (Cambodia) Plc. provides not only brokerage and research services, but also various types of advisory services: IPO, public bonds, M&A, private debt financing, and others.

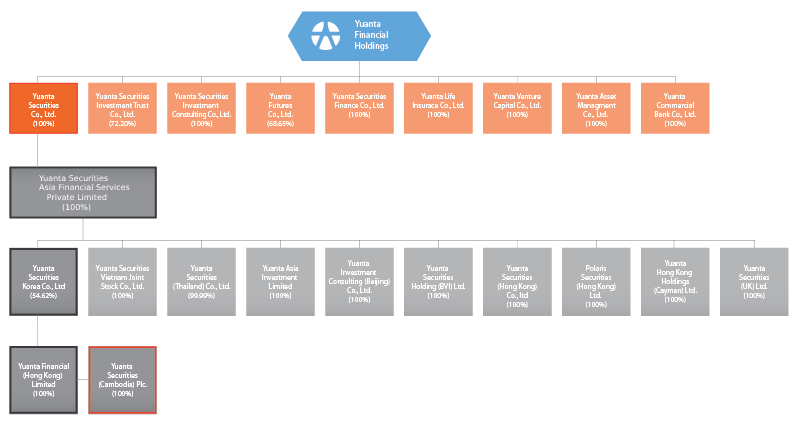

Shareholding Structure

Shareholder's Information

Yuanta Securities, the #1 stock firm in Taiwan

The #1 stock firm in Taiwan, is now expanding to major Asian markets instead of limiting itself. Our goal focuses on developing into a leading securities company in Asia through advancing to Singapore and South-east Asia by combining capitals and products in Korea, China, Hong Kong, and Taiwan as the center of North-east Asian finance.